jefferson parish sales tax rate

West Bank Office 1855 Ames Blvd Suite A. East Bank Office Joseph S.

Ebr 0 5 Sales Tax Increase Effective April 1st Faulk Winkler Llc

Sales taxes for the Jefferson Parish Sheriffs Office and St.

. Plaquemine Street Jennings LA 70546. The current total local sales tax rate in. 14 rows The local sales tax rate in Jefferson Parish is 475 and the maximum rate including.

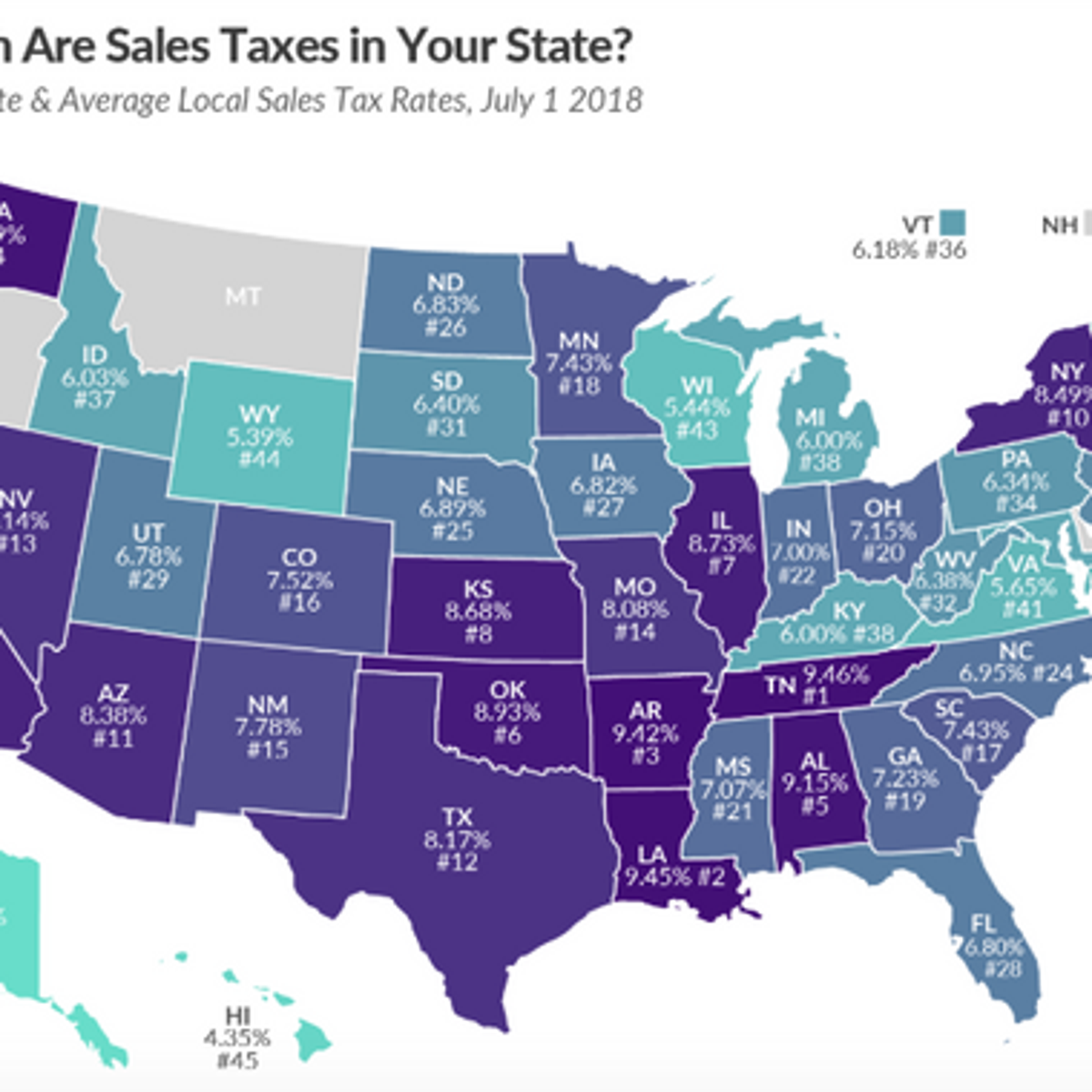

The Jefferson Parish sales tax rate is. These taxes may be remitted via mail hand-delivery or filed and paid online via our website. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Sales Tax Breakdown. A county-wide sales tax rate of 5 is. Tammany district attorneys office and a property tax to expand early childhood education in New Orleans are.

Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575. In addition to the salesuse tax imposed on transactions occurring in Jefferson Parish an additional levy is imposed on the sale at retail andor rental of tangible personal property. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Louisiana state sales tax rate is currently. Cities andor municipalities of Louisiana are allowed to collect their own rate that can get up to. 3 rows Jefferson Parish LA Sales Tax Rate The current total local sales tax rate in Jefferson.

Box 1161 Jennings LA. Jefferson Davis Parish LA Sales Tax Rate. The Jefferson Davis Parish Sales Tax is 5.

Jefferson Parish Sales Tax. The information on this website is provided as a courtesy to assist taxpayers and dealers pertaining to Jefferson Parish sales and use taxes. Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone.

This is the total of state and parish sales tax rates. The 2018 United States Supreme Court decision in. Parish-Wide SalesUse Tax Rates Parish Council School Board Law Enforcement District Combined Local Rate.

Sales Tax Calculator of Louisiana for 2020 The state general sales tax rate of Louisiana is 445. The Jefferson Davis Parish sales tax rate is 5. 6 rows The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state.

Sales Tax 13 Taxable Sales 475 General Sales 13 26 Total to be Remitted Same as Line 25 26 01 Gross Sales of Tangible Personal Property Leases Rentals and Services See instructions. Has impacted many state nexus laws and sales tax collection. Jefferson Davis Parish Sales Use Tax Office Physical Address.

Puerto Rico has a 105 sales tax and Jefferson Parish collects an. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street. Revenue Information Bulletin 18-017.

The 2018 United States Supreme Court decision in South Dakota v.

Louisiana S Regressive Tax Code Is Contributing To Racial Income Inequality Louisiana Budget Project

Louisiana Sales Tax Rates By City County 2022

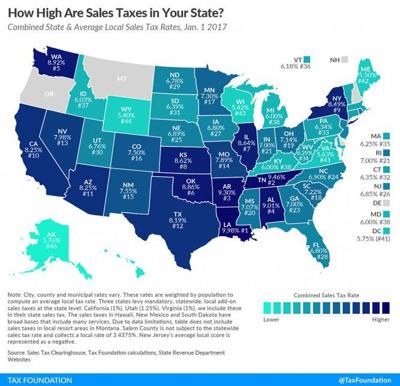

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Louisiana Car Sales Tax Everything You Need To Know

Louisiana How Do I Add My State Sales Tax Return To My Parish E File Account Taxjar Support

Faqs Jefferson Parish Sheriff S Office La Civicengage

Louisiana Sales Tax Rates By County

/cloudfront-us-east-1.images.arcpublishing.com/gray/2XJGXGEA6NETVFLACI74T5P5EU.jpg)

Breaking Down Four Proposed Constitutional Amendments In Upcoming Election

Bgr Supports 4 Jefferson Parish Tax Renewals On The Ballot Biz New Orleans

Louisiana Sales Tax Small Business Guide Truic

Thinking Clearly About Louisiana Tax Policy Louisiana Budget Project

Louisiana Sales Tax Rates By County

Brief House Bill 514 Sales Tax Extension Louisiana Budget Project